Unlocking the Potential of AI Startups in Drug Development

Yvonne Wu, Tensility Intern and MBA Candidate at Northwestern University Kellogg School of Management

Samantha Dale Strasser, CSO and Cofounder at Pepper Bio

Armando Pauker and Wayne Boulais, Managing Directors at Tensility Venture Partners

We are in an exciting age in drug development that promises to bring new - and better - treatments to patients, while reducing both the cost and time to market for new drugs. In large part, this is driven by the advances seen in computational analyses and modeling, notably artificial intelligence (AI). Researchers are leveraging AI to analyze vast amounts of experimental and clinical data to address a multitude of clinically relevant questions. These include developing an improved understanding of disease mechanisms, better identifying how to intervene and treat a patient, and computationally searching for new compounds to predict their effects.

A significant portion of AI-driven advances are fueled by startups. Fast and nimble, startups can quickly test and adopt new technologies, pushing the envelope in a way that large pharma does not. However, to date, these advances have been skewed predominantly towards discovery and preclinical work. While these are the foundational stages of drug development, they only scratch the surface of addressing critical challenges in drug discovery and treating patients [1][2].

In this blog post, we (1) discuss why startups have proliferated in the early stages but struggled to penetrate the clinical research stage of drug development and (2) present our observations on opportunities for AI-driven startups across the whole drug discovery life cycle. Figure 1 summarizes our perspective on the current opportunities and challenges for AI-based startups in this field. We aim to provide founders with a realistic picture of the challenges and opportunities that exist when pursuing AI-driven drug discovery.

Figure 1: The Landscape of AI Opportunities in Drug Discovery, created by Tensility Venture Partners

The Full Potential of AI is Untapped

In the last ten years, large-cap biopharma companies have seen a decline in the return on investment (ROI) in drug discovery from 10.1% to 1.8% [3]. This ROI decline is driven by the rising costs of the drug development process due to longer overall development times and increased complexity, with the average cost of developing a new drug rising by 15%, or $298 million, to $2.3 billion between 2021 and 2022 [4]. The excitement around AI in the pharmaceutical industry revolves around its potential to accelerate the “hit-or-miss” process of drug development and significantly improve the industry’s ROI.

Many articles have been published detailing the potential benefits of AI by accelerating the initial stages of the drug development process, including ideation and pre-clinical drug exploration. However, there is skepticism around the utility of AI in the later stages of drug development - specifically in clinical trials - driven in part by the lack of clinical validation of AI-generated

insights. This skepticism might be a reflection of the trends in the growth of AI-driven drug development startups over the last 20 years. Currently, companies that leverage AI are predominantly in the early stages of drug discovery. As depicted by Figure 2(a) below, there has been a dramatic increase in the number of AI-driven startups in the discovery and preclinical stages in recent years. At the same time, companies targeting later stages have not scaled much at all, with clinical trials being the most underinvested area in terms of AI-enabled drug development. This is not representative of the distribution of assets across phases for traditional pharmaceutical companies, as Figure 2(b) demonstrates [5].

Figure 2: Number of annual R&D programmes and assets over time, showing the growth of AI-enabled drug discovery. a | AI native drug discovery companies. b | For comparison, top-20 pharma companies. (Figure by BCG, AI in small-molecule drug discovery: a coming wave?, March, 2021, https://media-publications.bcg.com/AI_Drug_Discovery.pdf)

This is not surprising. Aside from cost intensity and riskiness, clinical trials can at times last over 10 years. Therefore, startups have not yet had sufficient time to prove their technology in the later stages of development. While many factors drive both graphs in Figure 2, this does highlight the short amount of time AI-driven startups have had to consistently prove their technology to date. With additional time, we anticipate that the expansion of startup companies into clinical stages of drug development will continue and accelerate, along with clinically relevant benefits.

Opportunities in the Discovery and Preclinical Phases

Startups are especially active and prevalent in the early stages of drug discovery due to the availability of data, vast economic potential, and competitive dynamics of the discovery and

preclinical stages of the development lifecycle. In 2023, BCG and Wellcome estimated that AI-driven R&D efforts could yield “time and cost savings of at least 25-50% from discovery up to preclinical stages” [5]. According to McKinsey, the use of Generative AI in this drug development stage has a higher potential economic impact than the clinical stages of drug discovery, with a potential of $15 to $28 billion in annual value generated [6].

The technological challenges faced in preclinical stages are well suited to the capabilities of AI, specifically through its data analysis, modeling, and predictive capabilities. For example, activities of the discovery and preclinical stages include in-silico compound generation/screening, target identification, and optimization of large molecule and drug-vector design. These activities and drug discovery, as a whole, entail complexities that are often well beyond the human mind’s ability to even comprehend (for example, the human genome alone has 3 billion base pairs!). With AI, we are suddenly capable of investigating mountains of data to tease out clinically relevant insights in a cost-effective manner [7].

Xaira, like numerous other startups, is using AI to model molecules and connect biological targets to diseases for drug discovery and has recently raised over $1 billion in a seed round. Insilico and Exscientia, for example, have also used AI to accelerate drug development processes. The race amongst pharmaceutical companies to quickly identify promising targets creates enormous opportunities for startups to extract value from this data. Thus, the unique accessibility of data during the discovery and preclinical stages, where data is less gated and cheaper to generate, is a key driving factor behind the ripe opportunities found in the early stages of drug development.

Opportunities in Clinical Trials

Clinical trials are both the bottleneck and most expensive stage of drug development. For that reason, if AI-driven startups can successfully impact even a portion of the challenges in clinical trials, they can have a transformative role in bringing new treatments to patients. Notably, a focal failure point in drug development is the ability to demonstrate a drug’s efficacy through human trials. McKinsey predicts that AI can unlock $13 to $25 billion during the clinical trials phase by helping big pharma companies design smarter trials, manage data better, and respond to regulatory queries and submissions faster [6]. Specifically, improving patient selection for clinical trials and identifying endpoints for better study design are places where AI has the potential to improve trial outcomes.

Despite this, we do not observe startup activity that matches the opportunity size. Additionally, given the current lack of approved drugs fueled by AI, scientists are highly split on its potential for clinical trials [9]. We believe that, while there is no lack of challenges to tackle in the clinical stages of drug discovery, startups are currently limited by clinical trials’ high costs and limited accessibility of sensitive patient data given its proprietary nature and value to large pharma. This data is a key source of intellectual property for large pharmaceutical companies, and thus,

highly protected. In fact, clinical trial data is so valuable that it is subject to information theft. In 2020, Chinese hackers conspired to steal design specifications, toxicology, dosing research, and other vaccine data from American pharmaceutical companies [10]. Consequently, we have seen AI developed within large pharma companies for clinical trial use cases, rather than sourced from external companies like startups.

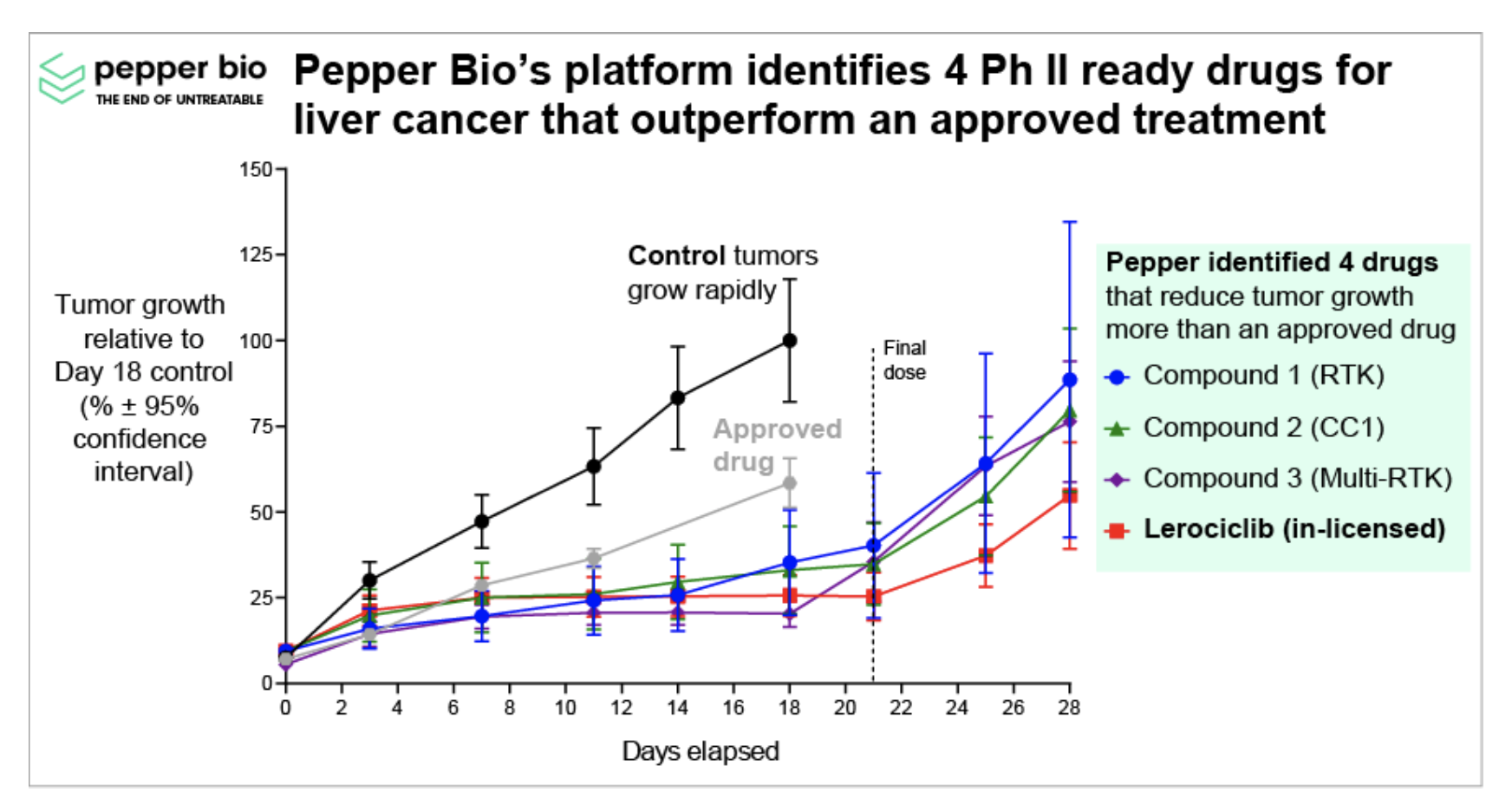

Despite these unique challenges, select AI-driven startups have successfully penetrated this space and secured investor funding, demonstrating what can be done through the right combination of novel technology, wise strategic decision-making, and strong product-market fit. For instance, Pepper Bio, a clinical-stage drug discovery company, utilizes a computational platform based on proprietary data and AI analytics to yield a functional understanding of diseases, advancing beyond traditional expression-based methods. They are using their platform to better identify high-potential assets (recently they identified 4 clinical-stage assets for treating an aggressive form of liver cancer), outperform approved treatments, and ultimately increase their likelihood of drug development success (see Figure 3). Recently, they in-licensed one of these assets, Lerociclib, which is now poised to begin Phase II clinical trials, thus enabling the company to overcome these data challenges. Achieving clinical-stage status in less than three years with under $8M in funding, Pepper Bio exemplifies how proprietary AI technology and strategic acumen can accelerate development. Another startup using a different strategy is Path AI, which has raised $395 million to date. They found success in offering clinical trial services less restricted by data access issues, including patient enrollment, stratification, endpoint measurement, and pathology services. These startups inspire optimism, demonstrating that successfully penetrating this phase of drug development is feasible with a thoughtful approach to delivering clinical impact, whether through partnerships with pharmaceutical companies, drug repurposing, or other strategies.

Figure 3: Pepper Bio’s platform identified 4 Ph II ready assets that demonstrated a greater ability to suppress tumor growth than existing approved treatments. The results presented here directly show their selected compounds significantly reduce tumor growth in animal models compared to an approved drug and control (no drug). (RTK = Receptor Tyrosine Kinase; CC = Cell Cycle.)

Opportunities in Production and Commercialization

As with the clinical trials phase of drug development, one of the challenges to startups entering the commercialization phase of drug development is access to data. Manufacturing in the life sciences industry relies heavily on trade secrets and patents to safeguard manufacturing mechanisms and process knowledge [11]. These are often big pharma companies’ key differentiators against each other and generic drug companies, especially for biologics. As a result, we expect that operational advances will be the use cases for AI-driven startups in these stages.

The value that AI has been projected to bring in this space is the highest of any of the previous phases discussed. McKinsey predicts that Generative AI can create $18 to $30 billion in value from commercial use cases and $4 to $7 billion in value from drug manufacturing and operations [6]. The economic value reflects how AI’s capabilities are uniquely aligned with the challenges in production and commercialization stages of drug development. As such, numerous pharmaceutical companies are using AI in-house for production and commercialization purposes: Merck and Sanofi to automate the inspection of vials used in vaccine manufacturing, Pfizer and Takeda to detect defects in tablet coating, and GlaxoSmithKline to analyze data and identify opportunities to reduce waste and improve product quality [12].

Where data is accessible, startups can create value through AI by unlocking greater productivity and making current processes in the industry more efficient. Streamlining documentation for regulatory purposes is a great first use case. For example, Octozi uses AI to streamline regulatory submissions, clinical documentation, and quality control. LighthouseAI supports regulatory compliance and tracks licenses and paperwork across states to enable supply chain and distribution functions. In the future, we also foresee startups using AI for procurement, supply chain, and other regulatory purposes within the pharmaceutical industry.

Conclusion

While AI’s effect on the pharmaceutical industry is in its infancy, we have already observed that AI-driven startups are proliferating in the preclinical stages, where ample data and vast computational resources can accelerate the generation of drug candidates. In contrast, clinical phases I-III have attracted far fewer startups, and we posit that this is due to a lack of access to data in addition to the high risk and costs of clinical trials. Still, creative companies are arising that are using their technical edge, data-driven platforms, and competitive strategies to overcome these challenges. They demonstrate that it is possible for startups to increase the likelihood of success and improve the economics of clinical trials through a thoughtful approach. The influence of AI startups on post-clinical processes in the life sciences industry, such as supply chain and distribution, will be most effective in addressing productivity solutions rather than driving technical innovation. Novel approaches and creative minds are sorely needed to scientifically and strategically tackle persistent challenges in the drug development lifecycle - used in combination, startups can unlock the potential of AI to deliver new and better treatments for patients faster.

References

A review of therapeutic failures in late-stage clinical trials | Expert Opinion on Pharmacotherapy

Roadmap: Unlocking machine learning for drug discovery | Bessemer Venture Partners

Deloitte pharma study: Drop-off in returns on R&D investments – sharp decline in peak

Unlocking the potential of AI in Drug Discovery | BCG and Wellcome

Generative AI in the pharmaceutical industry: Moving from hype to reality | McKinsey

Managing Unstructured Big Data in Healthcare System | Healthcare Informatics

The Staggering Cost of Drug Development: A Look at the Numbers | Greenfield

AI’s potential to accelerate drug discovery needs a reality check | Nature Editorial

Trade-Secret Vulnerabilities: Recent Hacking Schemes Highlight the Need to Protect

Proprietary Pharmaceutical Information | BioProcess International

The Risk of Pervasive Trade Secret Practices Within the Life Sciences | Harvard Law

Improving Drug Safety and Regulatory Compliance: How AI is Revolutionizing Quality